¶ Interviewee Recruitment

¶ What it is

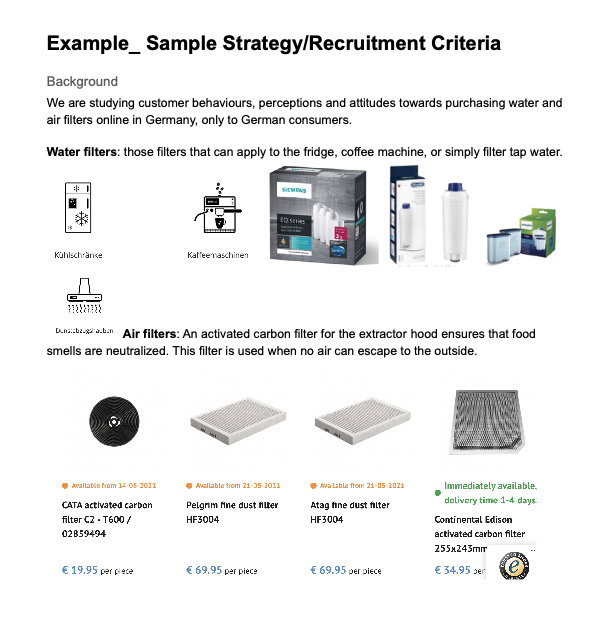

This is a process to determine whom you want to interview and why, which customer segments are included, which demographics are preferred, etc. Afterwards, a recruitment plan must be made to ensure a smooth recruitment process and that interviews are conducted on time.

¶ Why it is useful

This can help us identify interviewees and allocate resources more effectively.

¶ When to use it

This part is included in the research plan when we start planning customer research.

¶ How is it done

1. Determine the sampling strategy first. We usually will take 3-8 people in one customer segment (the quality of research can be difficult to guarantee with less than three people, and more than eight rarely tell us anything new that is relevant). For example, if there are four segments, the ideal number of interviewees would be around 12-32 (depending on available resources)

- How many segments are there?

- Are there any characteristics of interviewees preferred? Such as age, gender, income, status, etc.

- How do you strategically distribute the number of interviews to different customer profiles so that the sample is representative and holistic?

- What are the critical criteria for separating interviewee groups?

2. Finding people for the research. There are three common ways to look for interviewees:

- Reach out to existing customers ( e.g., frequent, one-time purchasers, never check-out buyers, etc.)

- User Interview Platform (e.g., user interviews.com) for new potential customers

- Reach out and outsource this work to a local agency

3. Make a concrete recruitment plan (when and how to find interviewees)

¶ Do's & Don't

Do's

- Sample strategy and recruitment plan should be included in the research plan.

- Consider bringing in non-customers or potential customers because they might have uncovered insights such as why they didn’t apply this solution, what alternatives they have, unique pains/needs, etc.

- Try to recruit interviewees from different sources to ensure the diversity of the data pool.

- You can offer interview incentives (500 RMB gift card, free products, free delivery service, etc.) to increase the success of interviewee recruitment.

- Prioritise the people you would like to learn from to fill your research gaps if there are too many target segments. Target low-hanging fruits first - whom do we want to know from the most, and who is easily approachable?

¶ Tools needed

- Whiteboard (virtual)

- Word

¶ Interviewee Recruitment Resources

¶ GenAI Tool Use Case

¶ Drafting & Optimizing the Recruitment Criteria and Process

Users can use Chat GPT to improve recruitment by creating detailed job descriptions, getting suggestions on qualifications and skills, accessing insights on inclusive language, and streamlining the overall hiring process for efficiency.

Key Steps Turtorial

- Give input of user profile, and ask for initial suggestions on screening criteria

- [introduce the context] Hello, we are a (here is company type) company specializing in (here is the signature product or offering). We hope to (here is the objective).

- [giving the brief] Now, I want to develop a recruitment strategy in terms of numbers per city, archetype, etc., as well as in terms of demographic considerations (if any) and potential red flags for recruitment. Try to have as few words as possible and be precise.

- Identify the recruiting channels and process

- Based on this criteria, please help to identify - where we could find our respondents, what is the incentive, and what is the recruitment process? Please consider (The key considerations to be included during this process)

- Plan the engagement and design the email templates for communication

- For each archetype, please write a post that might attract them and an email we could send them directly if we already know someone who fits. Please outline the (What factors that need to be considered, e.g. recruiting process, incentives, screeners and set the right tone for the next steps) in the communication.

Sample Prompt:

Sample Prompt:

Sample Prompt:

¶ Interview Screener

¶ What it is

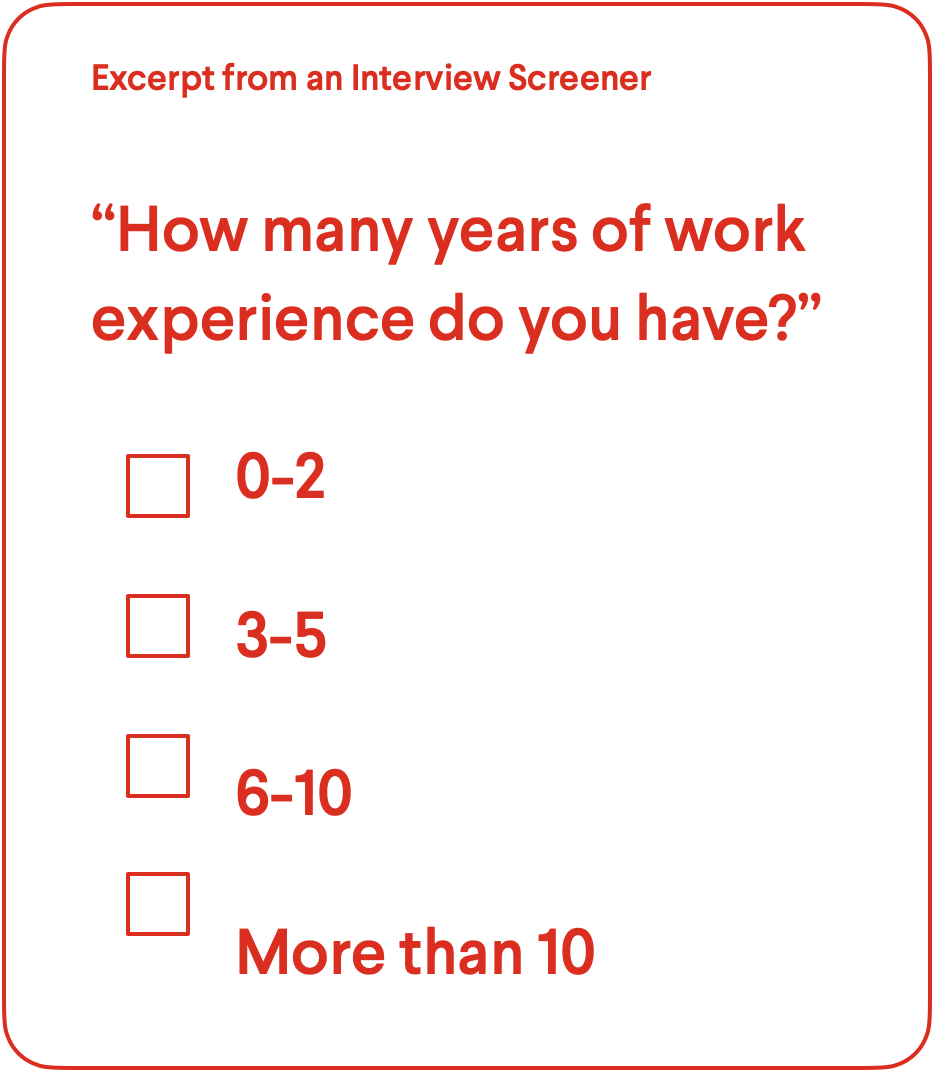

An Interview Screener defines the characteristics of the customers you are looking for and then turns them into a list of questions intended to identify your target customers and weed out those who aren’t suitable for your research.

¶ Why it is useful

The Interview Screener helps you to find the right customers to interview. Before starting your research, you want to ensure that your interviews will provide valuable insights so you can understand the customer’s experience, pain points, and expectations to address your Problem Statement.

¶ When to use it

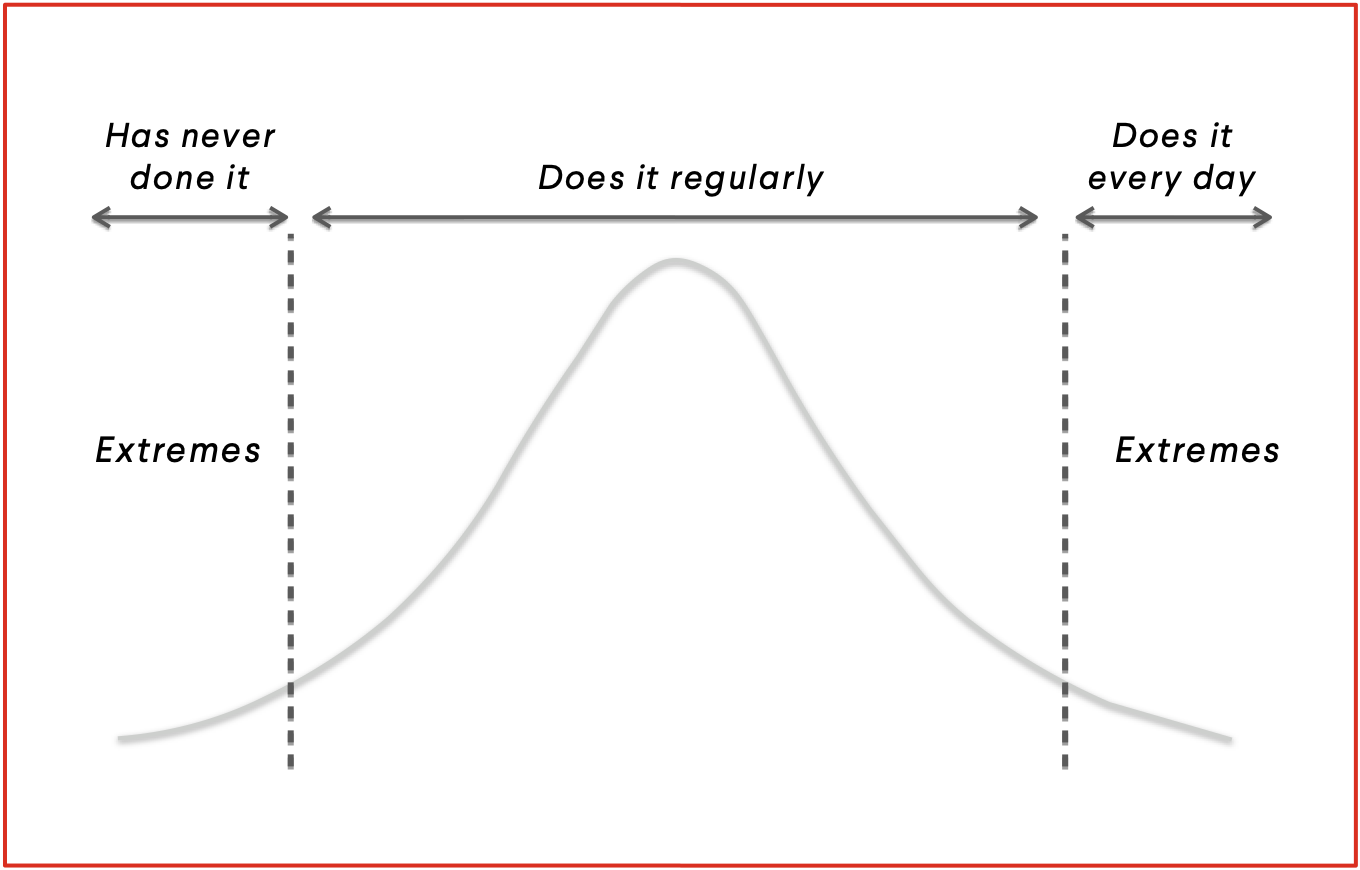

Finding the right test participants is vital for any customer-research project. Still, it becomes essential to identify a specific type of customer from a large pool of general consumers. Screening is necessary if you’re looking for: potential future customers, who aren’t yet customers but could realistically become customers in the future, customers with specific attributes (e.g., uses mobile for work), as well as extreme customers whose interest in a particular topic or activity is so strong that their knowledge and behaviour significantly differ from those of the ‘average’ person.

¶ How is it done

- Identify the types of people whose experience you want to understand. The Stakeholder Map can help you identify the right target audience.

- Identify the top few behaviours, contexts, motivations, and attitudes of the type of people you want to understand and formulate them into questions.

- A screener is often the first interaction a customer has with your research process, and you want to ensure it’s positive. Provide a warm, open introduction setting the context of the screener and the study.

- Ask elimination questions in the beginning, to avoid wasting people’s time (e.g., if you want experienced customers, you can ask about their experience with your product).

- Order questions from highest to lowest priority. This way, you ask as few questions as possible to eliminate inappropriate candidates.

¶ Do's & Don't

Do's

- Consciously choose whether you want to interview extreme or mainstream customers, and consider which characteristics distinguish them.

- Ask precise questions with clear answers. For instance, to know how frequently someone uses an app, use numbers of hours instead of vague terms like ‘sometimes’ or ‘often.’

- It’s also essential to include ‘other,’ ‘none of the above,’ ‘I don’t know,’ or ‘not applicable’ options. This way, candidates don’t feel compelled to pick the closest thing or something random and end up in your study when they should be disqualified or screened out.

Don't

- Don’t make your questions too easy. For example, if you want to talk to someone who has purchased a phone in the last month, don’t ask them that! Instead, ask which of a long list of items they’ve purchased in the previous month, with ‘phone’ as just one of many multiple-choice options. That way, they won’t know which option you’re looking for.

¶ Tools needed

- Word

- Markers and pens (virtual)

¶ Useful Tips

¶ Extreme Customers

Extreme customers are customers at the ends of the spectrum of people you address and are edge-case customers. They could be those who are very familiar or unfamiliar with the problem, frequent or one-time customers, etc. Their needs and wishes are amplified in comparison to average, mainstream customers. You should also include extreme customers in your research as the pain points of these customers could be more severe and insightful than the minor challenges of average customers.

- You can use an Interview Screener to recruit extreme customers.

- Make sure that both ends of the spectrum are represented - you don’t want to focus on extreme customers on one side only!

- Always keep in mind how the experience of extreme customers resonates with mainstream customers. Therefore, the product should be designed to delight all customers!

- When interviewing extreme customers, pay attention to workarounds and alternative solutions that they might have developed to get more valuable insights.