Previous

¶ Business Case

¶ What it is

The Business Case for a concept is the financial analysis of the concept's viability over a period that includes the original investment view and periods of operation with the requisite revenue and cost structure derived from the Business Model Canvas.

¶ Why it is useful

The Business Case helps you to analyse and communicate the financial potential of the concept at hand by translating the strategic choices of the Business Model Canvas into numbers that can be used to understand profit levels and investment returns.

¶ When to use it

A Business Case should be made for any initiative that requires investment and has a partially financial-driven investment and returns logic.

¶

¶ How is it done

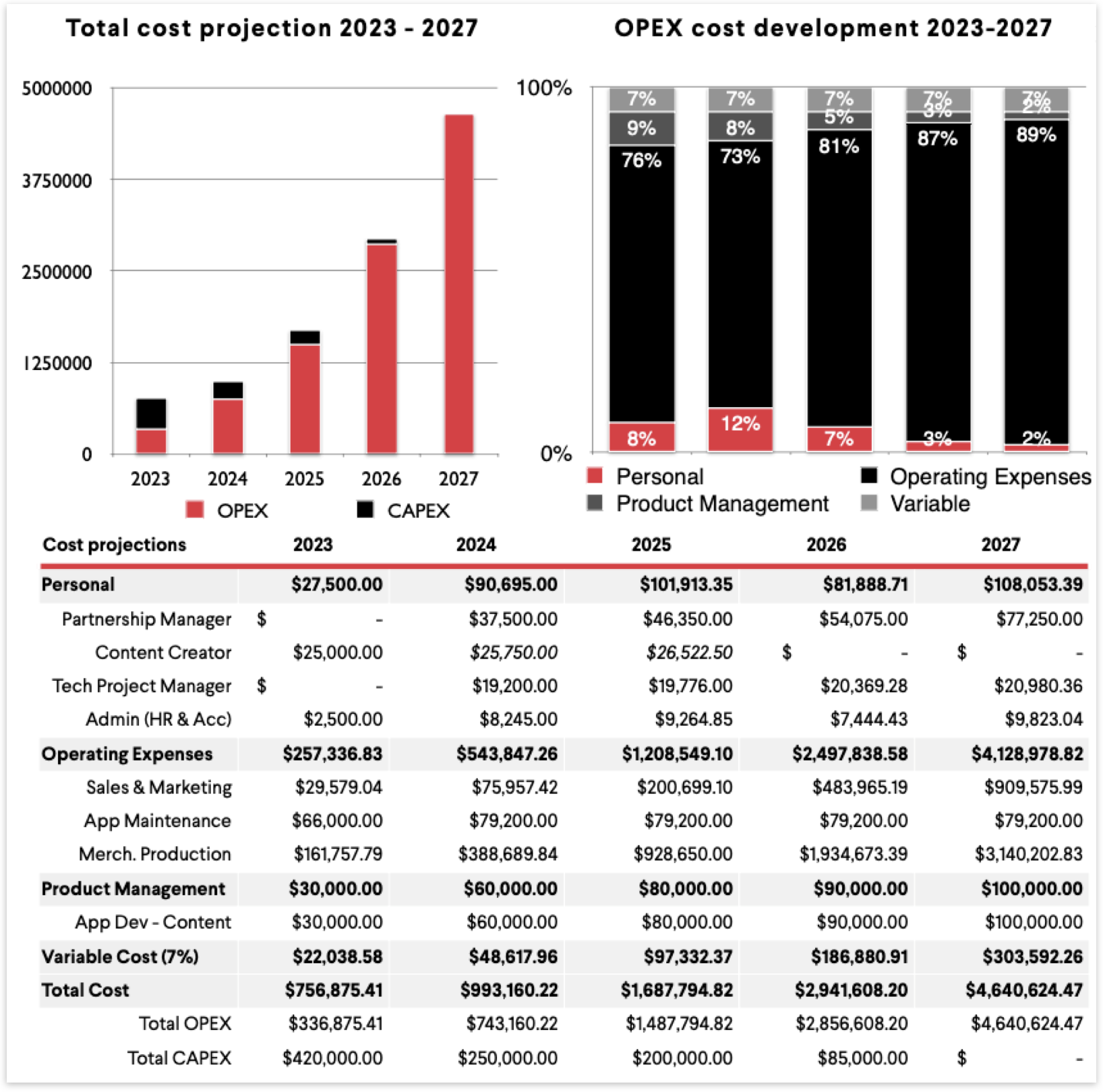

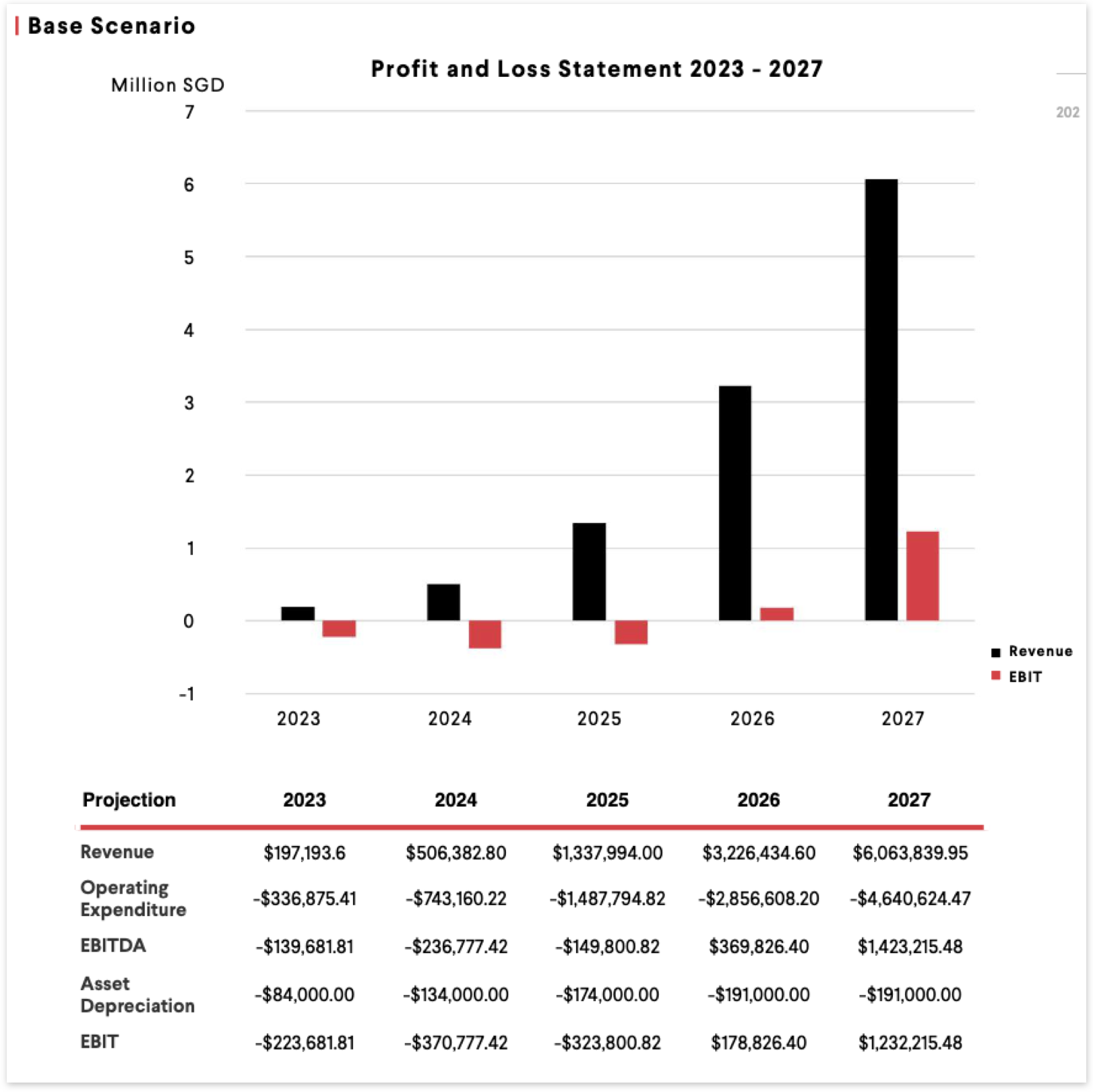

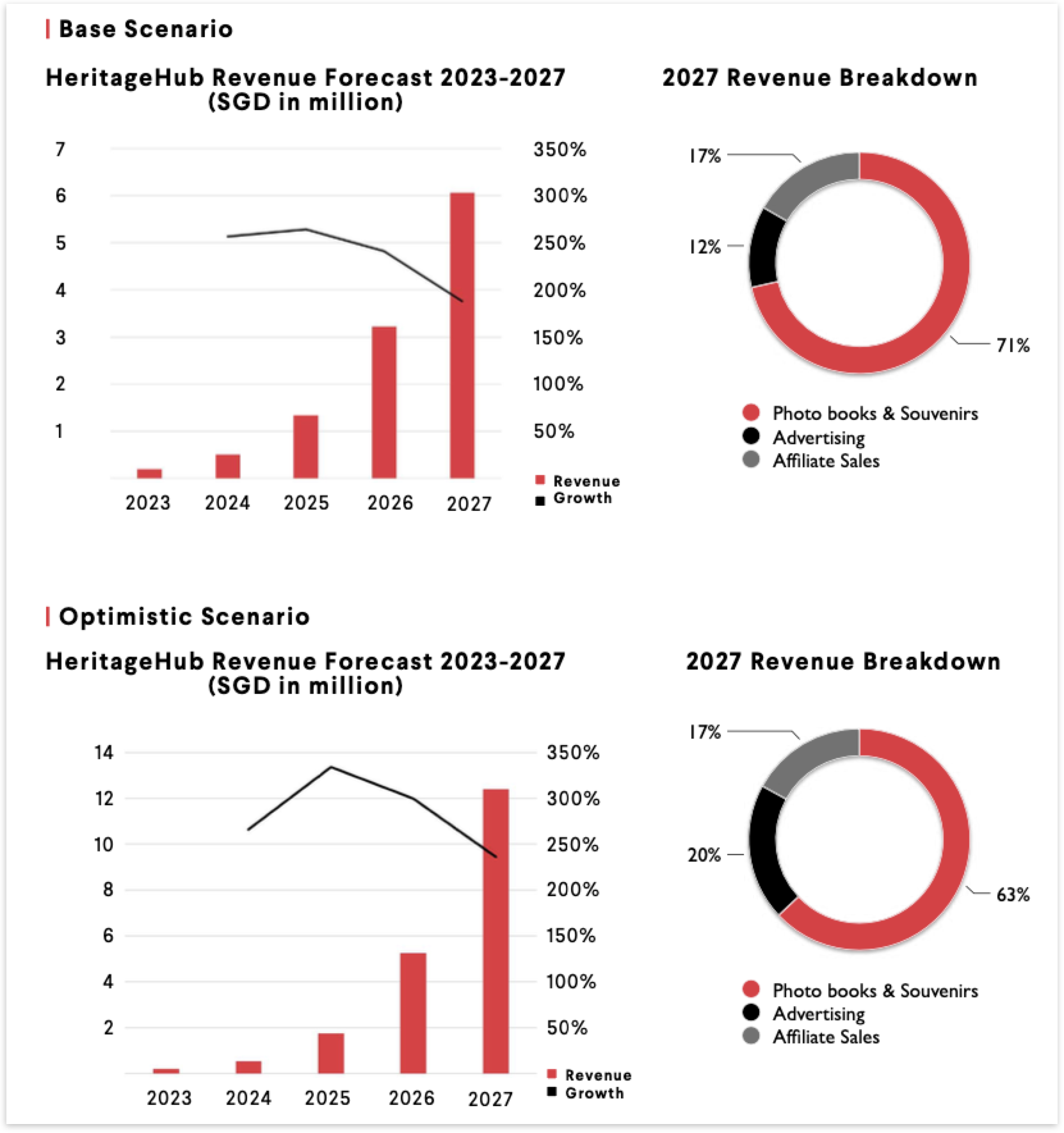

- Start by reviewing the Business Model Canvas and spelling out all your revenue and cost drivers.

- Map out the variables which lead to the dollar figures of the revenues and cost drivers - e.g., the Payroll will be determined by the number of staff and salary level per staff, built up over time.

- Create an XLS sheet following a standard business P&L logic, which models revenues, costs, and investments based on the underlying variables and drivers over 3 - 5 years (depending on requirements).

- Mark which fields are formulas (outcomes derived from variables) and which are manual inputs. For all manual inputs, mark whether they are based on facts (if so, reference where from) or assumptions (if so, reference why the assumption is made), or planning (if so, indicate why you plan like this).

- Run through the business case with the team and senior stakeholders, and iterate on key assumptions and plan figures until logical consistency and everyone finds the plan defensible.

¶ Do's & Don't

Do's

- Deeply analyse the cost and revenue drivers and the variables and formulas that determine their values. This is one of the critical purposes of the business case.

- Use as many facts as possible, and derive assumptions and plans with a defensible logic.

- Keep in mind the investment logic of the budget holders and the story that will help them understand what you are trying to communicate.

Don't

- Don’t be too over-optimistic or make the plan to some target figures. That distorts the purpose of the business case.

¶ Tools needed

- Whiteboard (physical or virtual)

- Post-it notes (physical or virtual)

- Filled-In Business Model Canvas

- XLS P&L Template

¶ Example