¶ Competitor Analysis

¶ What it is

Competitor analysis examines competitive players who also target a similar JTBD for customers and customer segments to gain insights into their offerings, sales, branding, and strategy.

¶ Why it is useful

Knowing your competitors is essential and enables you to stay on top of industry trends and ensure your product consistently meets and exceeds industry standards.

- Understand the industry and competitive landscape.

- Create a benchmark for the market and see where we can improve

- Evaluate our market position and identify the uniqueness

- Discover untapped niche market

¶ When to use it

Competitor analysis is most useful when you already wish to enter an established and defined market for a certain JTBD or customer segment. By reviewing what customers are exposed to today, you can see gaps in the market early, which can be instrumental in informing your later research..

¶ How is it done

1. First, identify the products and services you want to evaluate

2. Check if your products already have a clear definition in the market (usually, there is no defined market for disruptive/newly invented products)

- If yes, then draw out the landscape and directly seek your competitors and pinpoint indirect competitors

- If not, we need to dive into product & technology development and find out what exists today and why. Then we can define the product by the type of technology or different angles to solve the same problem. (For example, above, we do this to describe the landscape so that our research has a clear direction and structure)

3. After listing out all competitors (direct and indirect), determine which aspects you want to investigate (listed above is “what to look at,” such as channels, products, services, etc.)

4. Deep dive into each identified competitor and document your information. Depending on the project’s purpose, you can look at different aspects of competitors. Here are some common ones as references:

- Sales & Marketing Channels

- Product Features & Service Offered

- Social Media and Online Presence

- Customer Perceptions of Each Competitor

- Customer Journey Comparisons (Mystery Shopping)

- Pricing & Delivery Strategies

- Brand Strategies and Design

5. Summarise your learnings and identify areas to improve and how to execute the changes.

¶ Do's & Don't

Do's

- Try different methods to seek information, and don’t limit yourself to one source (online research, expert & customer interviews, paid reports, industry communities, etc.)

- Stay open-minded, and collect enough information about competitors before you conclude.

- Documentation is essential, and regularly updating the information can help you to observe market development.

Don't

- Don’t just focus on investigating one aspect of competitors; a holistic view indicates the direction and strategy of a company, which help you comprehend the market further.

- Avoid bias when concluding insights and comparing benchmarks (e.g., our product is still better despite lousy customer reviews, etc.) Instead, be realistic and stay with facts with an open mind to learn.

¶ Tools needed

- Whiteboard (virtual)

- Excel

¶ Examples

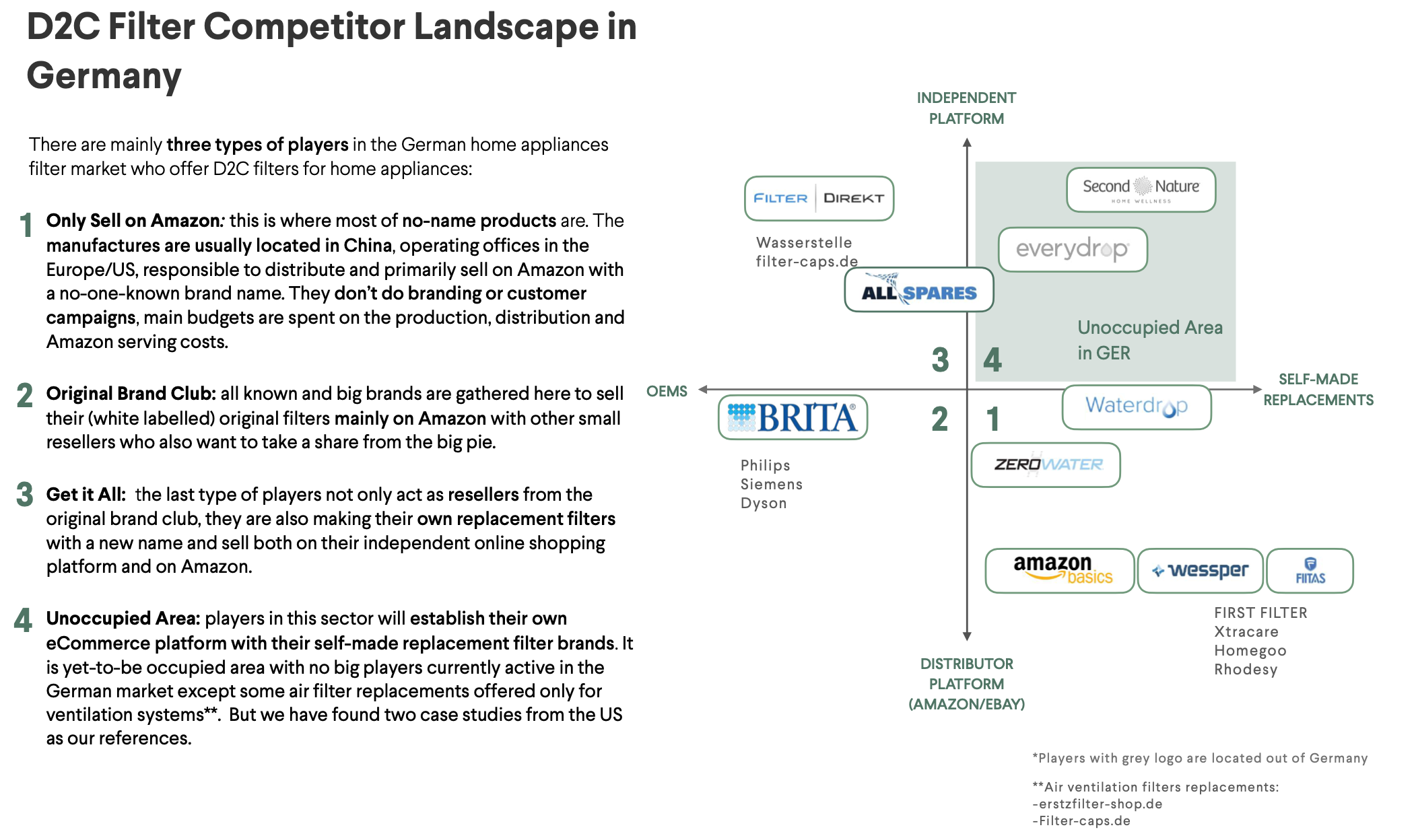

Example 01. Map out the competitive landscape

The competition landscape below is mapped for the B2C replacement filter market with a focus on Germany. All major players are listed and defined in the landscape. By doing this exercise, an untapped area and effective distribution channels have been identified. You can download the template and try it out!

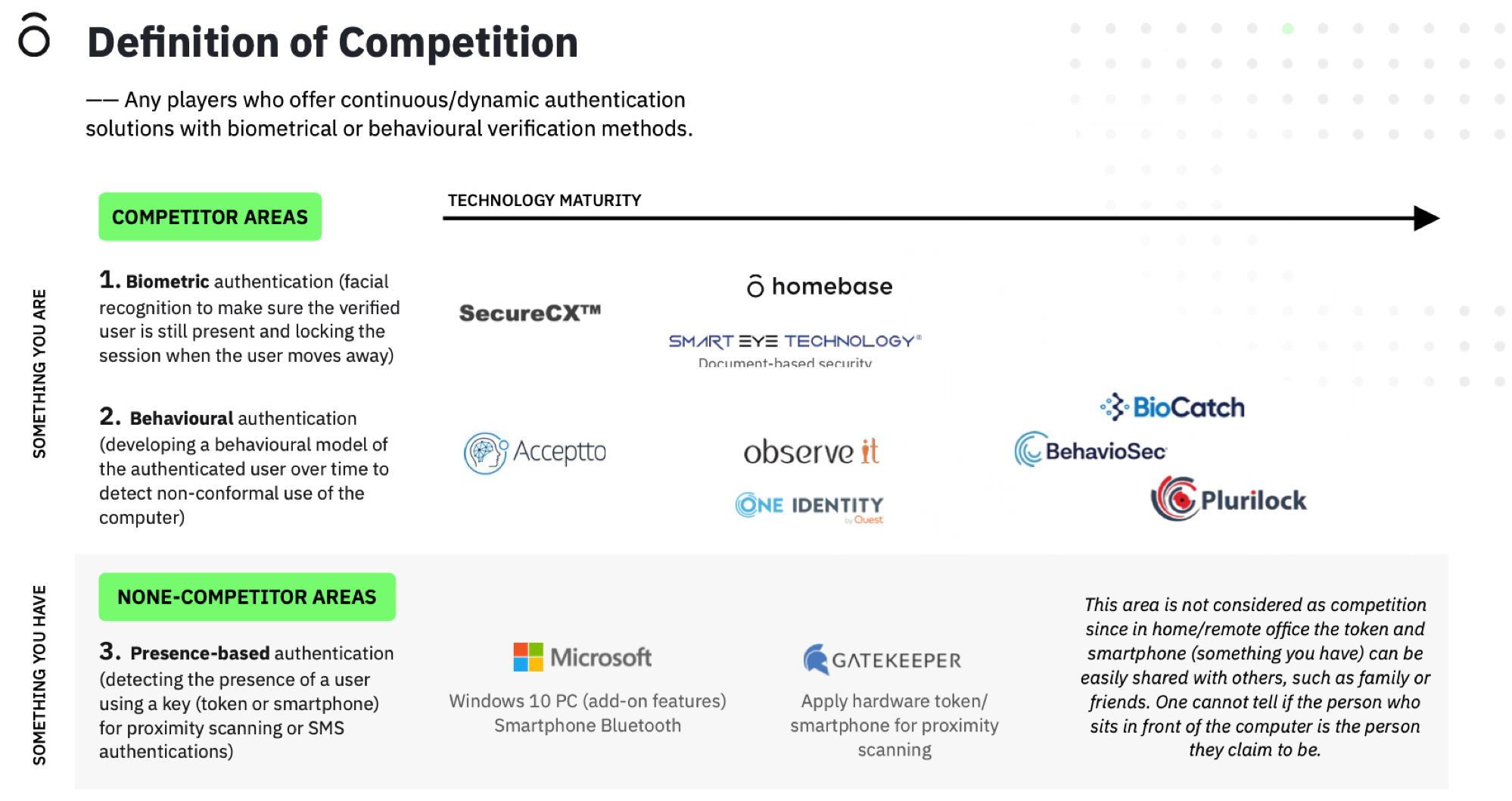

Example 02. Define competition in a new market

When we have a newly invented product with few competitors in the market, the competition area needs to be defined well for further analysis. In example 02, continuous authentication is a new market; there are no mature “all-in-one” solutions. So only significant players and new tech firms are selected in this definition. As it is very tech-driven, the level of tech maturity and authentication methods are identified as primary metrics for defining the competition.

You can follow the instructions in “how is it done.” This is not an easy process to define competition, so be ready to read industry reports, dive into technology developments and check out key opinion leaders’ views on this market (such as Gartner). There is no correct way (or one template) to do this task as long as the insights can indicate/guide our course of action and next steps.

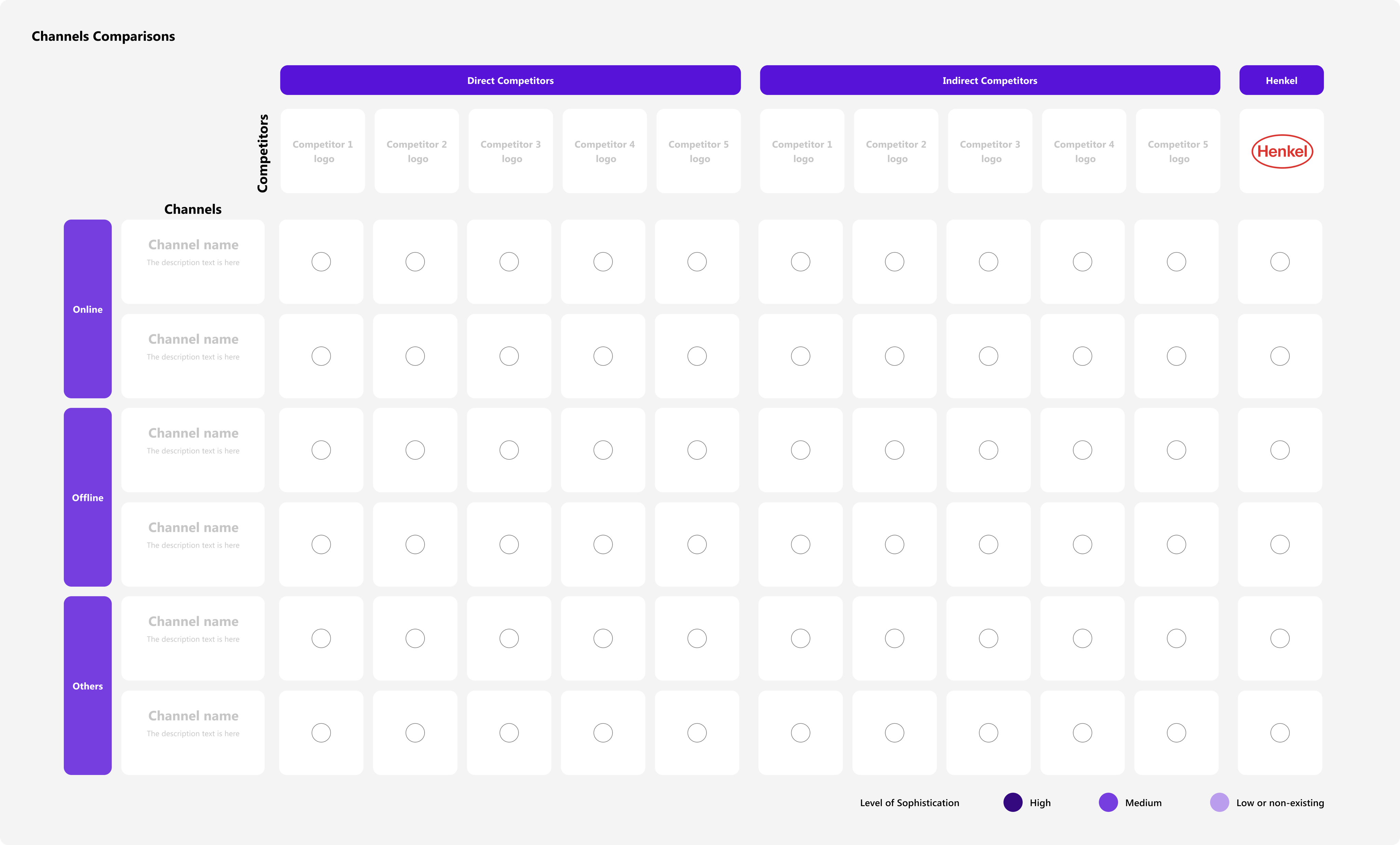

Example 03. Channel Comparison

When we want to improve our customer acquisition and sales & marketing strategy, a channel comparison is necessary to conduct and understand where we are today and which channel we need to consider for more investment.

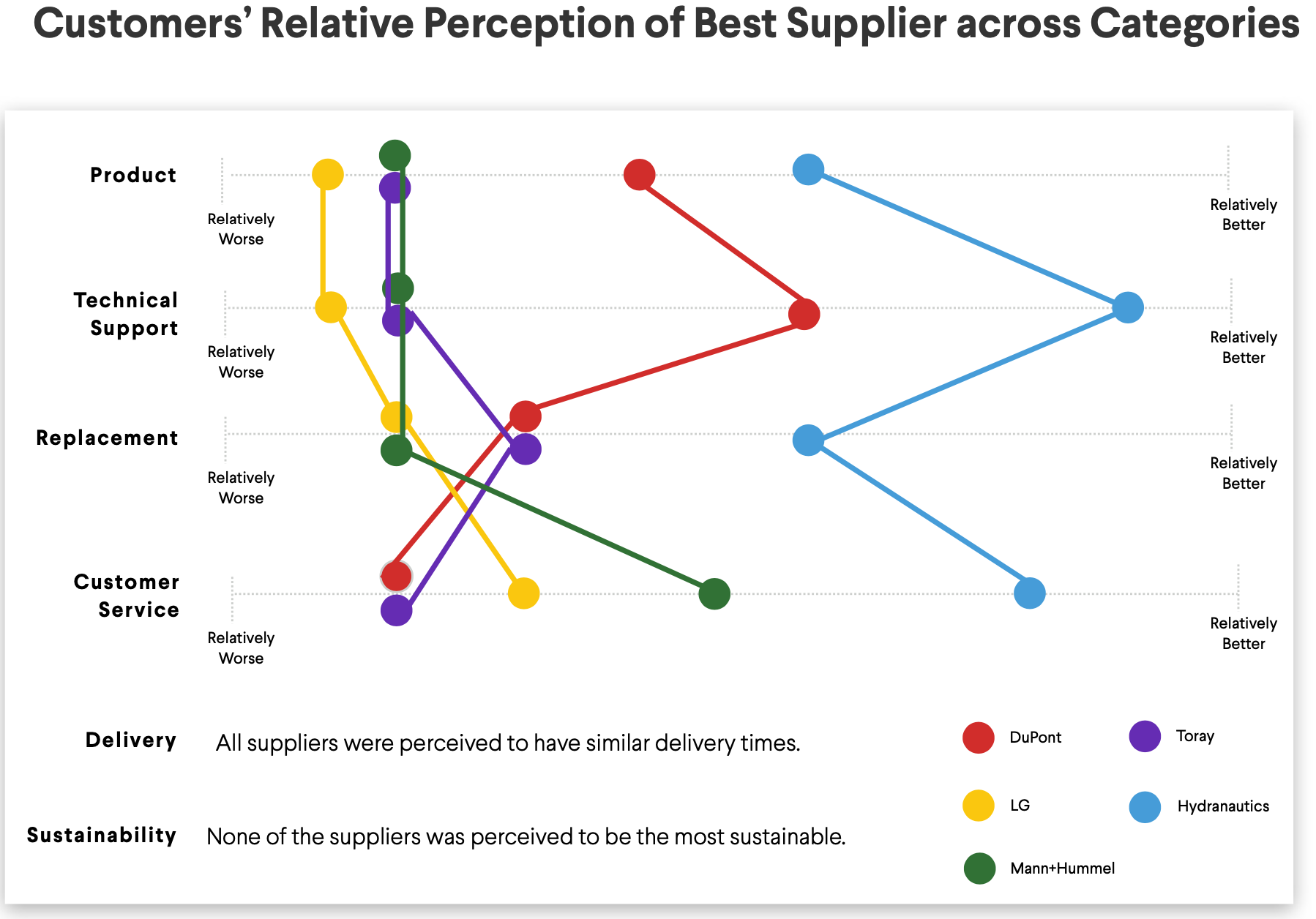

Example 04. Customer Perception Mapping

What we know about competitors is important, but what’s more essential is how customers perceive them. We need to understand whether they are a better provider than us and where we need to put our resources for improvement. Furthermore, you can discover many opportunities (even surprises) from customers’ perceptions of competitors.

Step 01: Select which players you want to compare.

Step 02: Define which aspects you want to compare (e.g., product, customer service, delivery, etc.).

Step 03: Conduct customer interviews and collect all feedback (you can go to the chapter on qualitative research and understand the whole process of customer research).

Step 04: Synthesise and map out the results on the matrix.

¶ Competitor Analysis Resources

![]() Competitor Analysis PDF Template

Competitor Analysis PDF Template

![]() Competitor Analysis Miro Template

Competitor Analysis Miro Template

¶ GenAI Tool Use Case

¶ Digging and Analysis of Competitor Information

In competitor research/analysis, users can leverage it to help businesses gather information and insights about competitors, enabling a better understanding of their strategies, strengths, weaknesses, and market positioning.

Tip & Tricks:

- Define your research objectives

- Prepare a list of competitors

- Collect relevant data

- Structure your queries

- Iterative questioning

Read More:

How to Make a Competitor Analysis Simply with Chat GPT?

Key Steps Turtorial:

- Introduce the Background and Understand the Competition Landscape

- [introducing the context] With the aim of (context of the competitor research), We wanted to understand how to leverage our product (x) to approach (introducing the target audiences) in the (specific target market).

- [giving the brief] To understand this market, our primary focus is to explore the competition landscape, e.g. who are the key players. Please give me the top (specific quantity) companies that require special attention.

- Deep dive into a Specific Competitor

- I wanna deep-dive a bit more about (Company A). Can you give me more data about their market share, value proposition and their key initiates? Please also consider (supplemental aspects to be requested).

Sample Prompt:

Sample Prompt:

Other Inspirational Tool:

Bard

Providing valuable insights and assistance in collecting and analyzing competitor information, human judgment and expertise are still crucial in interpreting the results and making strategic decisions.

Crayon

Employs algorithms and methodologies to process the collected data and generate reports, charts, and visualizations that help businesses understand their competitive landscape.

Talkwalker

A dedicated social media listening and analytics tool that specializes in collecting and analyzing social media data to provide insights and reports.