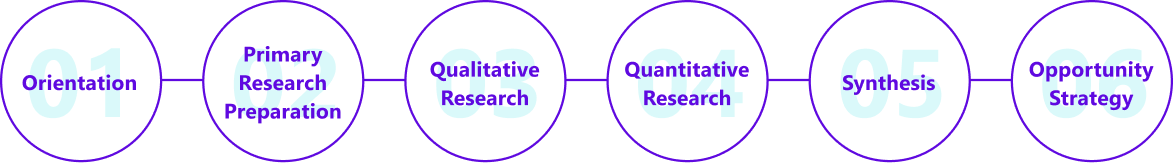

¶ Phase Overview

The objective of the Discovery Phase is to gain a deep understanding of a specific market and customer segments within that market. The goal is to deeply understand their Jobs-To-Be-Done, Pain Points, and Goals to find underserved needs that can yield new business opportunities.

These are the chapters of this phase. In each chapter, there are relevant skills and readings. You can start reading from the first page of this phase, or select the content from the table of content below.

Start Reading

¶ Discovery - Table of Content

¶ Orientation

We need a clear direction and purpose to start the discovery phase. We will align expectations with the team and key stakeholders, frame the problem we aim to solve, and gain insights from the market & competitors, which are the foundation of the following research

To effectively conduct research, we will need to understand the problem and set up goals:

Visioning & Goal Setting: Aligning the business vision and setting up discovery goals

Team Set-up & Team Building: Getting to know each other and defining responsibilities

Kick-Off: Starting the project with clarity and bringing everyone on the same page

Search Area Definition: Identifying the critical topics to be included in the research

Knowledge Transfer & Data Room: Sharing and leveraging existing organisational information

Trend Analysis: Understanding impactful market trends and future influences

Competitor Research/Analysis: Learning early from what others are trying and doing

Expert Interview: Seeking insights and different perspectives on key areas

Ecosystem Map: Mapping connections and relationships between all players in one system

Search Area Refinement & Discovery Goal Statement: Finalising research topics and discovery goals

¶ Primary Research Preparation

After we know our goals and business context, we need to identify our knowledge gaps on customers/users and set up a detailed research plan on how to close them.

To create a comprehensive research plan, we will set up the following:

Research Plan: Outlining all aspects involved in this research

Interview Guides: Scripting the interview process and guideline

Interviewee Recruitment: Finding the people to answer our questions

¶ Qualitative Research

In this chapter, you truly get to know the customer through research and get a picture of the current state of their jobs-to-be-done, needs, and pain points. Instead of working from assumptions, you venture to understand the customer‘s experience, context, and constraints. This chapter introduces different tools to engage in customer research.

There are six most common and frequently applied qualitative research approaches:

Customer Interview: In-depth one-on-one interviews directly with target customers/users

Focus Group Discussion: Group conversations with multiple target audiences

Shadowing: Real-life observation of a research participant for a set period of time

Mystery Shopping: Going through the same experience as a typical customer

Service Immersion: Understanding the perspective of the service provider/staff

Diary Study: Capturing customers’ regular actions, as well as their feelings and observations

¶ Quantitative Research

While qualitative research gains a deep understanding of the customer's thoughts, motivations, and context, quantitative research can help you gain insights into numeric variables (how many, how much, how often, and preferences/trends) on a much larger scale.

To collect quantitative data, we can look at the following:

Survey: Sending out a predetermined set of questions to research participants

Analytics: Looking at different data sources that give you information on the existing behavior of customers across touchpoints

Studies & Statistics: Accessing and leveraging that existing quantitative data on specific markets and topics

Social Listening: Making use of information shared by customers online

¶ Synthesis

After we have conducted customer research, we need to process and analyze the collected data. In this chapter, we will discuss the whole process of dealing with and synthesizing qualitative data.

To synthesize qualitative data, we will go through the following:

Data Transcription: Collecting qualitative data in real-time for further analysis

Interview Mining & Analysis: Clustering and summarising data in a structured manner

Customer Insights: Drawing insights that should be considered or incorporated into your solutions

Root Cause Analysis: Identifying underlying causes in your Insight Statements or pain points.

Jobs-To-Be-Done: Finding out what “jobs” people want to get done by using products/services

Personas: Capturing personality, behaviour, challenges, and needs of a specific customer group

Customer Journeys: Visualising a customer’s experience over time as they interact with the product and service

System Thinking/Iceberg Model: Making sense of the complexity by looking at things as wholes

¶ Opportunity Strategy

Finally, we have gathered all important facts and insights, from which we develop opportunities and find ways to move forward.

To find the way moving forward, we will go through the following:

Opportunity Maps: Discovering new areas for a customer-centric product, service, business model development, etc.

Opportunity Prioritisation & Selection: Reviewing and selecting prioritized opportunities for the next steps (a foundation for conceptualization in the subsequent validation phase)